Measure 102

Combines public and private housing dollars

Yes

Oregon faces a housing crisis, not just in Portland but across the state. This measure would amend the Oregon Constitution to allow more efficient financing of affordable housing projects.

When the city of Portland persuaded voters to approve $258 million for affordable housing in 2016, the plan contained one major flaw: Because of the state constitution, the city could not leverage that money to build more units. It could not use the money to partner with private developers or nonprofits, or borrow against the bonds, thus raising more money to build housing.

That meant only the city could own affordable housing properties that the bond proceeds built or acquired.

Measure 102 would clear away that hurdle. Local governments would still have to make their case to taxpayers any time they want to borrow money to pay for affordable housing. (Metro is asking for $653 million on this ballot for that purpose—Measure 102 would make that money stretch much further.)

Just about everybody believes it's a good idea: Lawmakers in both parties voted unanimously to refer the matter to voters, and there's no organized opposition to the measure. We are typically wary of amending the constitution, but in this instance, it's warranted.

Measure 103

Bans grocery taxes

No

This measure is the proverbial solution in search of a problem.

It would enshrine in the state constitution a prohibition on taxing groceries.

But nobody's seeking a statewide tax today on milk or beef or apples or any other foods. Instead, this measure is a pre-emptive strike against the state adopting a sales tax, even though in the vast majority of states that have sales taxes, groceries are exempt.

Our concern with Measure 103 is that it goes a lot further than just protecting what people put in their shopping carts and on their dinner tables. By broadly defining "groceries" as anything "from farm to fork," Measure 103 casts a wide net and would complicate Oregon's already byzantine, broken tax structure.

It would prohibit, for example, taxes on at least some restaurant meals. Opponents say it could also prohibit future changes to the gas tax and result in a host of other unintended consequences.

In 2016, WW said no to Measure 97, a proposed $3 billion gross receipts tax. Our logic was simple: Tax policy made at the ballot box is sloppy. That measure, backed by labor unions, failed in part because voters feared companies that paid the tax—including grocers—would pass the cost along to consumers.

And so grocers are back, using scare tactics to make tax policy at the ballot box—and lock it into the constitution.

Voters elect lawmakers to work out complicated policy and figure out how to pay for it. Direct democracy through the initiative process can be a powerful counterweight to incompetence or the sway of special interests in Salem.

But this measure serves those special interests as surely as anything that comes out of the Capitol. Grocery store chains spent big to get this on the ballot. (Kroger and Albertsons-Safeway as well as the soda companies' industry group, the American Beverage Association, have given more than $1.5 million in cash each during petitioning and the campaign.)

And on a more practical level, Measure 103 ties policymakers' hands at the state and local levels in ways even more harmful.

The measure would prohibit the future imposition of taxes on sodas and other sugary drinks that cities such as Seattle and San Francisco have passed. And it would also probably protect the tax-free status of e-cigarettes and vaping supplies.

In short, this measure is as messy as Hamburger Helper. And there's no way for lawmakers to clean up the slop: The measure would be inscribed in the constitution. Just say no.

Measure 104

Requires a three-fifths vote to raise fees or eliminate tax breaks

No

This constitutional amendment was placed on the ballot by the Oregon Association of Realtors, who fear Democrats will try to pass laws reducing or eliminating the tax deduction for interest paid on home mortgages. The Realtors have a legitimate concern: In 2017, there was an unsuccessful attempt to do just that, and some lawmakers have vowed to keep trying.

But 104 is more problematic than it seems—because it goes far beyond the question of home mortgages. It would require a three-fifths majority vote of both legislative chambers to increase any legislatively set fee (there are 2,400 of them) or to reduce any existing tax break (there are 367 of those). Right now, lawmakers can eliminate a tax break—such as the Business Energy Tax Credit, which squandered $1 billion in revenue—or raise a fee, such as the cost of a fishing license, with a simple majority vote. To approve a new tax or increase an existing tax, such as the income tax or gas tax, requires a three-fifths majority of both chambers.

Debating whether mortgage interest should be deductible is exactly the kind of drab but important work lawmakers are supposed to do. Instead, voters are being asked to make complex tax policy with one sweeping measure. That's almost always a bad idea. So is the idea of amending the Oregon Constitution.

Right now, lawmakers can create new tax breaks with a simple majority vote. Tax breaks cost the state and local governments $12 billion a year in forgone revenues. This measure would make it much harder to claw back what the government gives away.

If Measure 104 passes, it would create a "roach motel" effect: Lawmakers can easily put subsidies and tax breaks for corporations and wealthy individuals into law, but they can't get them back out. Thumbs down.

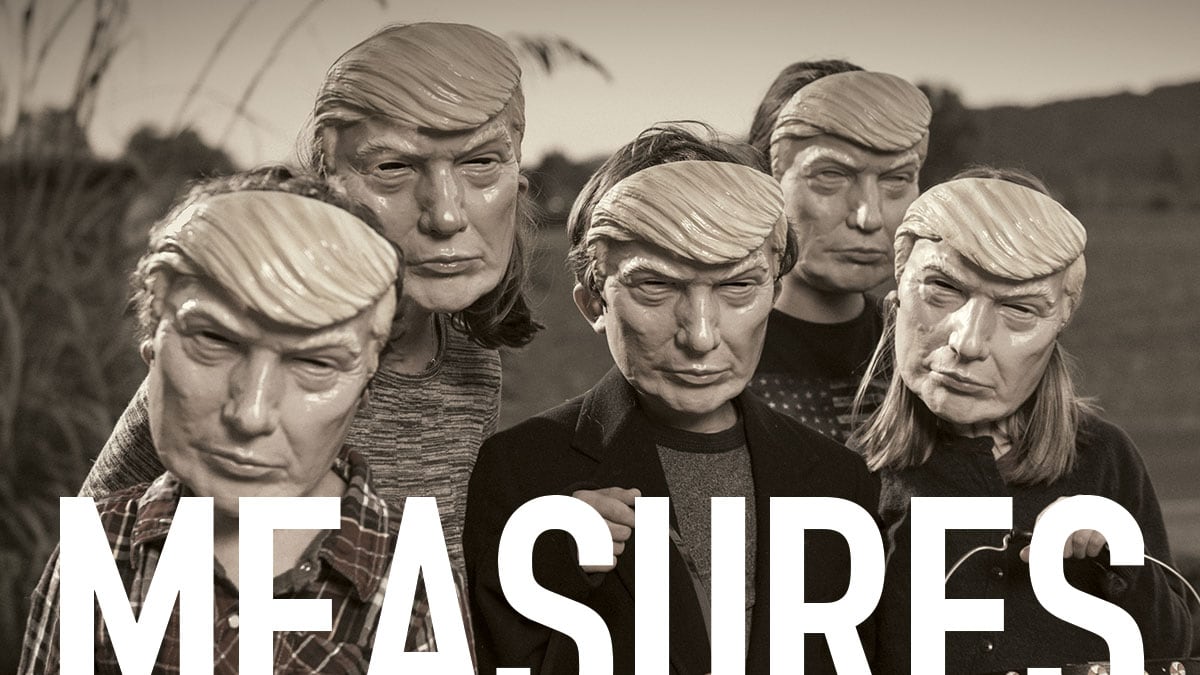

Measure 105

Repeals Oregon's sanctuary law

No

In 1987, Oregon lawmakers overwhelmingly passed a "sanctuary law" that restricts state and local law enforcement agencies from using their resources to enforce federal immigration policies. The law prevents local officers from detaining people whose only offense is living in the U.S. illegally, and from assisting the feds in investigating whether someone is living here illegally.

They wanted to restrict the racial profiling of their Latino neighbors—some of whom, even U.S. citizens, were being pulled over by police on the thin pretext of checking their citizenship.

No honest observer would say the political climate around immigration has improved. Immigration agents tear families and towns apart—even without the help of local police. But the backers of Measure 105, Oregonians for Immigration Reform, want to repeal the sanctuary law. They didn't bother showing up at an endorsement interview to defend the specious, race-baiting arguments they used to put the measure on the ballot.

Indeed, there are moral, financial and public safety arguments against repealing the law.

Yes, people living in Oregon without legal authorization have broken a law. But it is a federal law, and there is an entire federal agency dedicated to enforcing it: U.S. Immigration and Customs Enforcement. Oregon police shouldn't be enlisted to do ICE agents' jobs.

Proponents' fear-mongering claims about criminal immigrants are so overblown they're essentially fiction. Data shows immigrants are far less likely to commit crimes than U.S. citizens.

Perhaps most convincingly, the opposition argues that repealing the law would silence crime victims and witnesses afraid of risking deportation for coming forward. That could leave citizens and immigrants alike in danger.

The claim is well-founded. Law enforcement agencies in Texas reported a sharp drop in the number of domestic violence calls in immigrant communities after the state passed a law requiring local cops to aid the feds. We don't want to see that happen here.

Reject this bad idea.

Measure 106

Bans state funding for abortions

No

For the nearly five decades since Roe v. Wade, Oregon has stood as the only state in the nation not to chip away at abortion rights.

But here's Measure 106, which would bar state funding for elective abortions for women below a certain income level. It would also require that the state no longer carry health insurance for employees that covers the procedure.

We have long supported the right to choose and see no reason to change our position now. Proponents of this measure claim it would not restrict any woman's right to choose an abortion. That claim is false. Not providing public dollars would disproportionately affect low-income women who depend on the Oregon Health Plan to pay for the procedure. It would also unfairly limit health care coverage for public employees in a state where private providers are required by law to cover abortions.

Proponents argue taxpayers shouldn't have to fund something they fundamentally disagree with. But taxpayers have to do that all the time. Don't like wars? Bummer! You still pay for them. Hate logging? Your taxes still fund state forestry. You get the point: The same principle applies to women's health.

The state only spends about $2 million each fiscal year on abortions paid for through the Oregon Health Plan. That's 0.005 percent of the state's budget. That small amount provides an essential public health service to women who would otherwise struggle to access abortion.

Abortion is already safe, legal and rare in Oregon. It's also accessible to women of all income levels and circumstances. We should keep it that way.

Measure 26-199

Metro housing bond

Yes

There's no question the Portland area needs more affordable housing.

More than 6,000 people currently sit on waitlists for housing vouchers, and none of the three counties in the Portland area is accepting new applications. The official estimate is that the region is short 48,000 units for the region's lowest-income residents.

That's why Metro, the regional planning agency, is asking voters for a $653 million bond could help build 3,900 homes in Multnomah, Washington and Clackamas counties. That means the owner of a house with an assessed value of $250,000 would pay an extra $60 a year.

That won't solve homelessness. But it's a start toward addressing the rising cost of housing in the region that continues to push low-income Portlanders out of the region.

Two years ago, Portland proposed a similar housing bond. We recommended a "no" vote. (Voters ignored us—and approved a $258 million bond.) Part of our concern was that the city wasn't building the most possible units at the least cost to taxpayers.

But this time, a constitutional amendment—Measure 102—is also on the ballot that would allow more units to be built with each dollar. (See our endorsement on page 24 for how that would work.) Without that rule change, the new bond remains inefficient. With it, the bond dollars could go further. We urge you to vote for these measures as a joint ticket—and ensure the biggest bang for your buck.

Our endorsement comes with reservations, however.

We remain frustrated that cities across the region aren't doing more to foster market rate development. Portland still holds up the permitting and design review process. City Hall has been glacially slow on a proposal to add more apartments to neighborhoods that still look like suburbs. The Portland Housing Bureau still hasn't made the most of its scarce dollars.

But those complaints aren't a good reason to reject more public investment in housing for our poorest neighbors.

Metro, by being a three-county agency, has the scope to make the entire region address a regional issue. Spreading the cost across three counties also keeps the tax burden low. Five bucks a month is a bag of Halloween candy. Homeowners can swallow it.

This measure doesn't do enough—but it does something. Vote yes.

City of Portland Measure 26-200

Limits campaign contributions in city races

Yes

Oregon's campaign finance system is broken.

The candidate with the most money wins Oregon legislative races 92 percent of the time, one study showed. And only a tiny fraction of Oregonians ever contribute to political races. That means a handful of people—plus labor unions and corporations—with a whole lot of money effectively decide who will represent you in government.

Oregon is one of just a half-dozen states that have no caps on campaign contributions.

This measure won't tame that Wild West. Instead, think of it as a sheriff in one frontier town. It will cap donations in Portland city races. (Supporters of this measure plan to go to the ballot in 2020 for statewide spending caps.)

Measure 26-200 would cap individual contributions in city races at $500 and forbid corporate donations while allowing PACs that are funded by a group of small donors. A candidate's own contribution to the campaign would be capped at $5,000.

We agree with all of these ideas. We're not sure they'll stand up in court. A similar measure passed overwhelmingly in 2016 by voters in Multnomah County was ruled unconstitutional by a circuit judge. The backers have appealed.

We don't know how that case will turn out. But as we argued in 2016, the idea is a good one and worth pressing the courts to reconsider.

City of Portland Measure 26-201

Business tax for clean energy projects

No

This takes the prize for the measure with the best intentions but the worst execution among any we've seen this year.

We understand the powerful appeal of Portland's Clean Energy Initiative. Backers say it would help low-income Portlanders and communities of color save money on their utility bills by making their homes more energy efficient. As an added bonus, a chunk of the money raised would go to job training for the same historically underserved communities.

The rationale undergirding this idea: Utility costs and the impacts of climate change both disproportionately affect low-income and minority Portlanders.

The source of the proposed funding will also appeal to many voters. The initiative would slap a new tax on big corporations such as WalMart, Comcast and Wells Fargo. Such national giants are easy targets. They make lots of money, pay low rates of state income tax and just got a windfall from President Donald Trump's tax plan.

Half to three-quarters of the money raised would be spent on energy efficiency and projects that reduce carbon emissions. The rest would go toward job training for low-income and minority workers. Proponents, who include more than 150 nonprofits representing a wide range of environmental, community and labor groups, paint a picture of low-income Portlanders installing solar panels, new insulation and better windows on their homes, creating jobs and helping to meet the city's ambitious carbon reduction targets.

Sounds good, right? Well, there are a few problems both in who'd actually pay the tax and how the money would be spent.

First, although proponents deny it, the tax would fall hardest on the very people it's supposed to help: the poor. The initiative imposes a tax on gross receipts—that means sales. In an analysis of the measure last year, the city's Revenue Division asserted "some businesses will partially or wholly pass the [tax] on to consumers in the form of a price increase."

Second, the measure does not require that investment of the tax dollars in energy efficiency actually go to the homes of low-income Portlanders. Measure guidelines say that "at least half of the grants in this category should specifically benefit low-income people and people of color." Why not all of it? Why allow half to go to people who are neither low-income or people of color? And in legal terms, the word "should" is not the same as "must." In fact, it's such a weak guideline that all the money could be spent entirely for the benefit of middle-class whites.

Nobody agrees on how much money the tax might raise. Estimates range from $35 million to $79 million a year. That's a big variance. And unlike many special-purpose taxes approved by voters—such as the Portland Children's Levy or funding for the Oregon Historical Society, both of which must be reapproved regularly by voters—there is no sunset clause for the Clean Energy Fund. Even the Multnomah County Library employed temporary funding for 36 years before becoming a permanent taxing district in 2012.

So we have a tax that would come out of the pockets of people it claims to help, with no guarantees the money would go to them, or any way to shut the spigot off if the experiment fails.

And, as the left-leaning group Tax Fairness Oregon points out, Portland is already far ahead of most cities in terms of weatherization, which, in any case, is not the most pressing challenge Portlanders face. "This measure appears to put the climate far above the education of our children, where we rank bottom in the country, housing our citizens, or preparation for a seismic event," the group said in a Voters' Pamphlet statement. "Let's put our limited resources towards our biggest problems." Vote no.