The Oregon Lottery made a net profit of $968 million last year, according to a preliminary July 22 report to the Lottery Commission. This is the lottery’s highest profit ever, one-third higher than the previous record set in 2019.

Chuck Baumann, spokesman for the Oregon Lottery, says the high profit is important for the lottery’s purpose. “It’s what the mission of the lottery is, to earn a maximum profit for the state,” he says, “but commensurate with the public good.”

The record haul comes amid a reexamination of whether lotteries prey upon the poor.

A study from the Howard Center for Investigative Journalism this month found that the Oregon Lottery and its peers target communities of color and people with low education and income.

The study shows that the area in Multnomah County with the highest number of lottery retailers—17 of them—is a downtown census tract. The tract has a median household income of $17,704, substantially lower than the overall county median of $72,425.

The study’s findings are all too familiar. The National Gambling Impact Study, created by an act of Congress in 1996, predicted the demographic patterns of lottery players.

“We’ve always known that lotteries disproportionately impact marginalized individuals, BIPOC individuals, older adults, and veterans,” says Kitty Martz, executive director of Voices of Problem Gambling Recovery.

Martz notes that those are all likely recipients of government spending. “So one of the really confusing parts,” she says, “is how we got to having a publicly operated system.”

Baumann attributes the concentration of lottery retailers in certain neighborhoods to the cost of real estate, not a disproportionate targeting of the poor. “It’s going to be more expensive to have a storefront in downtown Portland than it is in downtown Gresham, or the outer reaches of Portland itself,” he says.

Oregon is heavily dependent on lottery dollars. The lottery is the second-largest source of state funding, after income taxes. Lottery revenues fund public schools, state park enhancements, Outdoor School, and some veterans services. Legislators also like to use lottery bonds for projects in their districts, such as the $12 million Senate President Peter Courtney (D-Salem) secured in 2017 to renovate the Salem YMCA.

“We’re kind of addicted to these bonds and the projects they fund,” says Rep. Marty Wilde (D-Eugene), who chaired the House General Government Committee last session. He says Oregon is so dependent on lottery funding that any protective reform that restricts lottery revenues would also create a problem for bond projects that are supposed to be funded by lottery dollars.

“Not only would we not have all those budget sweeteners in terms of lottery bond projects, but we’d probably have to subsidize the existing bonds from funds of some kind,” Wilde says. “So it really prevents us from making thoughtful decisions.”

The temporary solution instead would be to call a moratorium on lottery bonds until the impact of gambling on marginalized people can be more closely investigated, he says. Wilde also notes that the most profitable games are also the easiest to abuse, such as video poker, and therefore the games themselves should also be examined.

“I’m not anti-gambling, but I think we should have games that are more protected and don’t let people get in over their head before they realize it,” Wilde says.

Martz cautions that the record profits the lottery reported last week do not include the societal costs of gambling. Victims of gambling addiction often end up relying on the state for SNAP or Oregon Health Plan benefits because of their losses.

“It’s an absolute redistribution of money from people who are marginalized to support these bonds to support the more privileged people of Oregon,” Martz says. “It’s a regressive tax on the poor.”

Gambling in Multnomah County Preys on the Poor

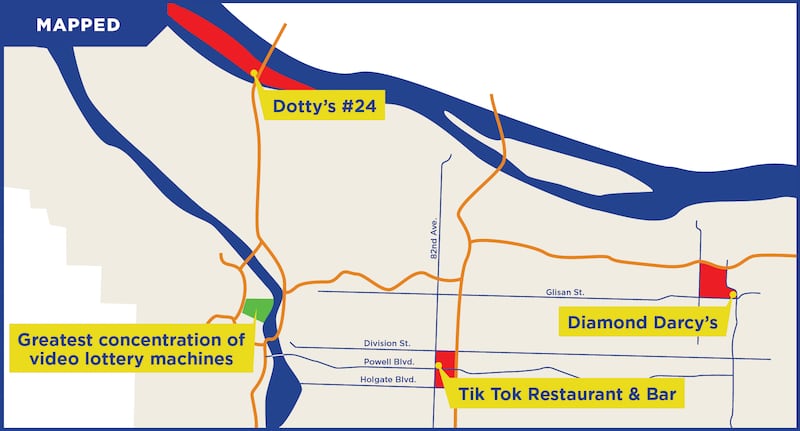

Three of Oregon’s 10 highest-earning lottery retailers are in Multnomah County. The highest earner of the three, the Tik Tok Restaurant and Bar on Southeast 82nd Avenue, lies in a census tract where incomes are less than half the county average. Darcy’s in Wood Village is also in a low-income area, while Dotty’s #24 on Hayden Island is an a higher-income area but gets bridge traffic from Washington, which has no video lottery games. The greatest concentration of video lottery machines in the county is in a census tract (center) where average income is less than a quarter of the county average.