As 2022 draws to a close, Oregon’s cannabis industry can only hope for better results in the coming year.

Three charts tell a story of oversupply, which led to lower prices for retailers, who are far more numerous than in other states. All of that resulted in less revenue than the state forecast.

Consumers benefit, of course, from the bounteous harvest. But Oregon’s struggling substance use disorder industry, which depends (since the passage of Measure 110 in 2020) on cannabis taxes, will get less money for treatment than expected.

Here’s the first chart (all three come to us courtesy of the Oregon Office of Economic Analysis).

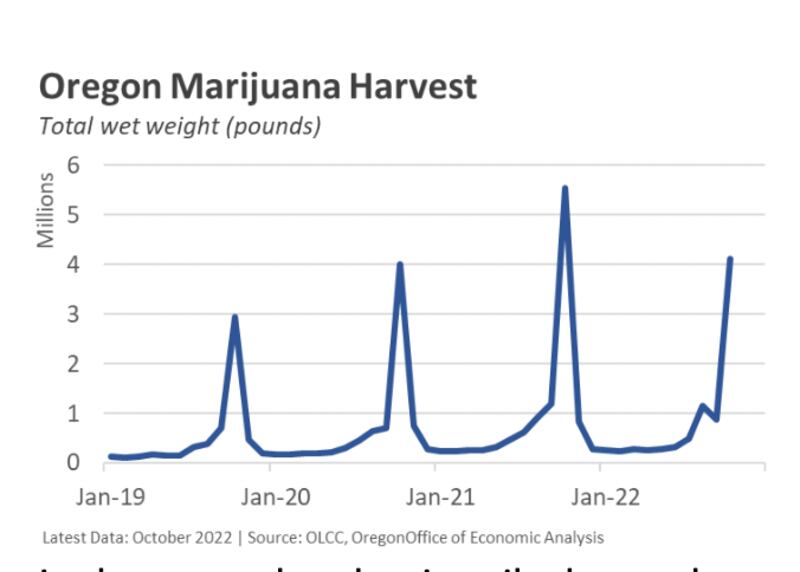

Legal Cannabis Harvest Over Time:

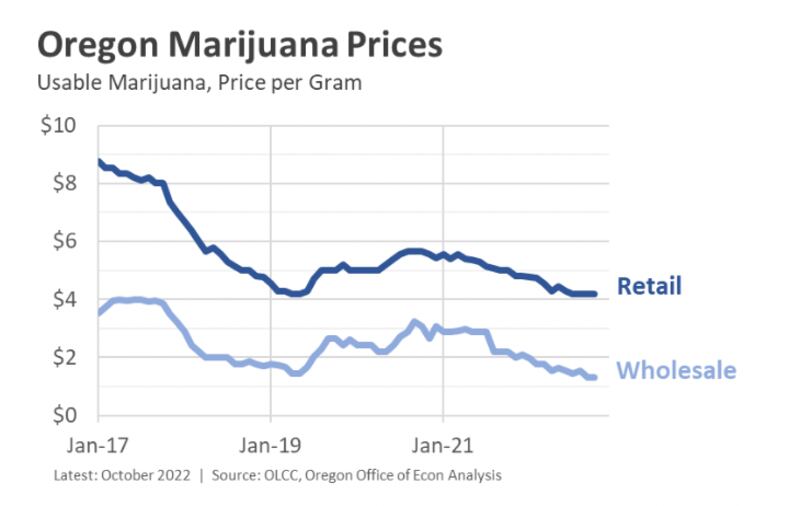

Bumper Crop Leads to Lower Prices:

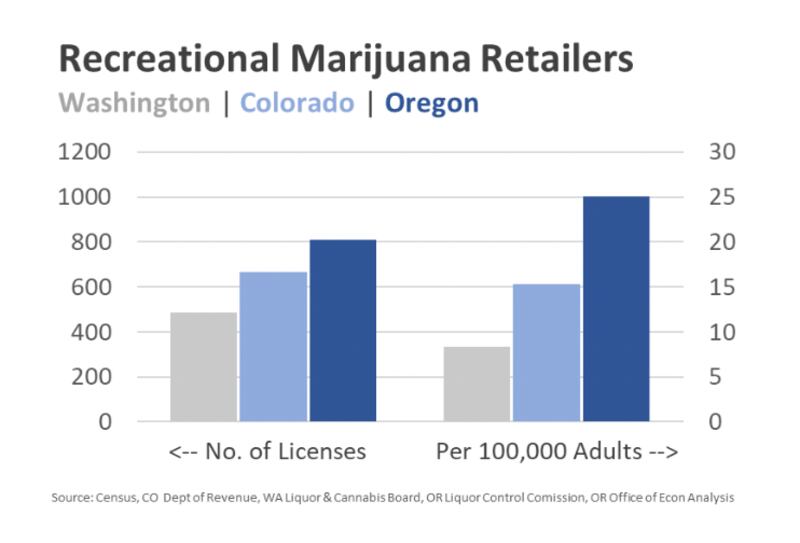

Lots of Retailers Means Lots of Competition:

As the Oregon OEA noted in its December revenue forecast, Oregon has licensed far more cannabis retailers per capita than comparable states (about three times Washington’s number, for instance). That means consumers have a lot of choice and retailers are locked in stiff competition.

“This is great news for consumers who can enjoy widely available products at low prices,” OEA economists wrote. “This is bad news for firms trying to operate a profitable business. One challenge there is even as businesses do leave the market, to date there has always been another willing to step in and take their place.”

The Oregon Department of Revenue taxes cannabis at 17% of the retail price, so as oversupply pushes prices lower (see first chart), state tax revenues decline. In the December revenue forecast, state economists projected that total revenues for the 2021-23 biennium would be about $310 million—a lot of money, but $30 million less than originally forecast.

In that December forecast, OEA economists noted that initial signs from the fall harvest point to the market strengthening next year.

“Year to date, the marijuana harvest is down 18 percent compared to last year,” the economists wrote. “Right now it is unknown to what extent this could be weather- or crop-related compared to a fundamental decrease in production. However, a reduction in supply should eventually lead to better pricing power for firms.”