Lawmakers on the Oregon House Revenue Committee got an hourlong tutorial Jan. 18 on the state’s income tax system. One eye-catching statistic in the flood of numbers: Oregon added high-income earners at a prodigious rate in 2020.

COVID-19 caused unemployment that peaked at 14% and left many businesses hamstrung for much of the year. Nonetheless, state figures show the number of Oregonians earning more than $500,000 jumped strongly in 2020—up 11.25% from 2019.

To Jody Wiser of the watchdog group Tax Fairness Oregon—the only spectator who actually attended last week’s hearing in person—that jump at the high end is “surprising.”

“Anecdotally, you hear people are leaving the state,” Wiser says. “But the data show the number of people at the high end of the income scale increased a lot.”

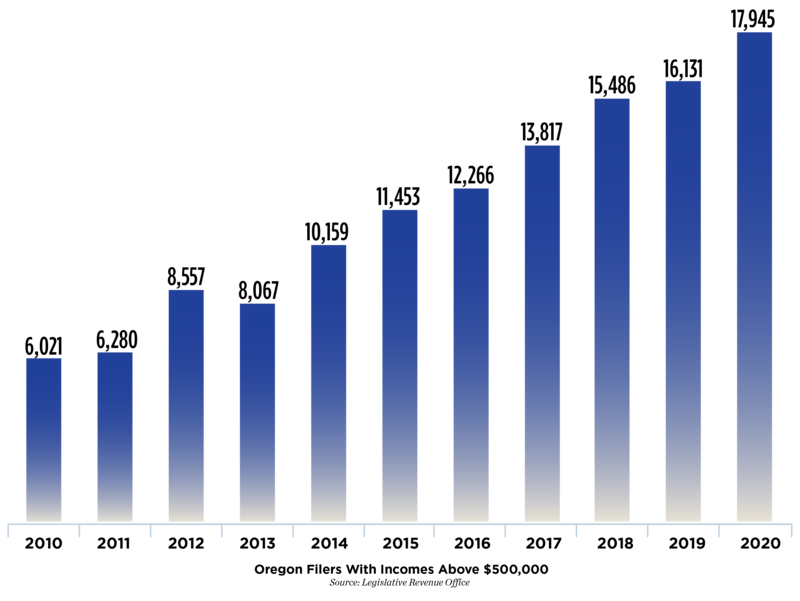

Wiser notes that the growth in incomes in Oregon in the past decade has been heavily concentrated among taxpayers who make more than $100,000, and the biggest gains have come at the top: The number of Oregonians who make more than $250,000 tripled. Those who make more than $500,000, for instance, increased from about 6,000 to nearly 18,000 (see graph). They increased far faster than the state’s population and saw more gains than the taxpayers who earned less than six figures.

With Portland’s population having dropped 1.7% in 2021, some groups argue Oregon’s income taxes, among the nation’s highest, are causing an exodus.

Oregon Business & Industry, the state’s business lobby group, released a report in October noting that a slew of new taxes in Portland and Multnomah County puts the city in rarefied territory. “New York City has the highest combined state and local top marginal income tax rate, followed by Portland, Oregon,” the OBI report said. (The group did not respond to a request for comment.)

Of course, the state’s most recent income tax figures are from 2020, and two of the taxes on high earners in Multnomah County—Preschool for All and the Metro homeless services measure—only passed that year, so things may have changed since then.

Juan Carlos Ordóñez, a spokesman for the Oregon Center for Public Policy, is skeptical. Ordóñez notes that Portland minted new millionaires at the highest rate in the country from 2010 (when the state last increased income taxes) to 2017. He adds that a significant body of research shows people rarely move solely because of taxes.

“If they did, there’d be no rich people in Portland,” he says. “They would all long ago have moved to Vancouver.”

Ordóñez doesn’t deny some people are leaving, but he says the increase in the number of filers at the high end of the income scale is indisputable.

“The well off and the business community try to scare people by saying the rich are going to leave,” Ordóñez says. “But higher tax rates don’t really determine whether people leave. Lower-income folks tend to move more often than rich people.”

Here’s how the number of filers with incomes above $500,000 has changed in the past decade: