A new report released today by Metro Auditor Brian Evans says the regional government is doing a better job tracking expenditures from the $652.8 million regional housing bond voters approved in 2018.

Evans’ team determined Metro generally followed the direction in a 2021 audit that found lax oversight and issued nine recommendations for improvement. For example, auditors wanted to see better metrics for quality; quicker production; a conflict-of-interest policy; an examination of lessons learned on each project; clearer reporting on administrative spending; and the development of a plan for potential future bonds.

“Metro made significant progress on past audit recommendations and developed the foundational structures for its housing work,” the new audit found. “Seven recommendations were implemented. Two were in process.”

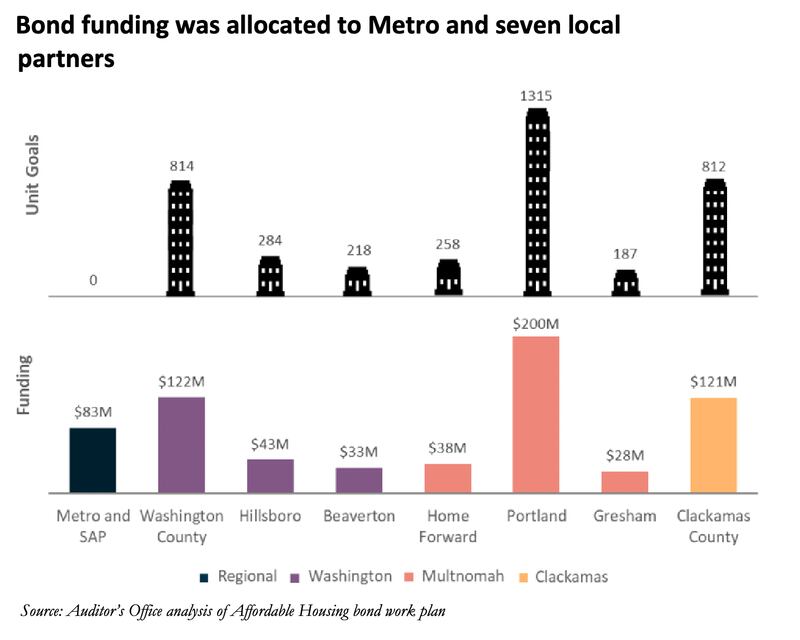

Auditors also reported that the bond could produce as many as 4,700 units of new housing, well in excess of the original goal of 3,900. As of the end of the 2023 fiscal year, 34% of the bond proceeds had been spent, either by local government partners or Metro’s central administrators. As of August, auditors added, 981 units had been completed and 1,600 were under construction.

The purpose of the bond is to subsidize the construction of new affordable housing for people making less than 60% of median family income. Metro allocates the funds across the region to city and county governments and, for east Multnomah County, to the nonprofit Home Forward.

The auditors noted that progress in putting taxpayer money to work has been uneven. “Completed units included three multifamily apartment buildings in Portland, four in Washington County, two in Clackamas County, two in Gresham, and one in Beaverton. No units had been completed in Hillsboro or through Home Forward in east Multnomah County.”

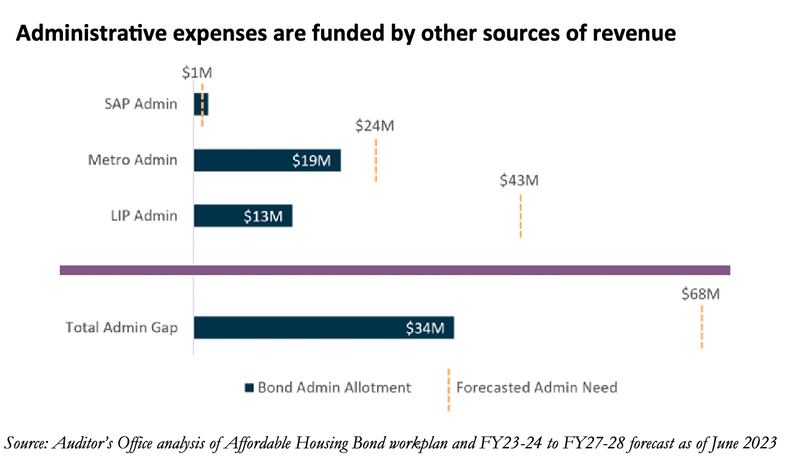

Perhaps the biggest finding in the audit is that the bond’s 5% administrative cap doesn’t cover the costs for Metro and its local partners to allocate the funding and track expenditures, including making sure the money is spent efficiently and benefits the low-income families it is supposed to help. Auditors determined the cost of administration will total $68 million from inception through fiscal year 2027-28.

The shortfall will be greatest for the local partners—such as the Portland Housing Bureau—which will have to find funding for oversight and monitoring from other places in their budgets.

In a response to the audit, Metro chief operating officer Marissa Madrigal and housing director Patricia Rojas said the big picture is bright.

“To date, the Metro Affordable Housing Bond has exceeded every goal set by the measure and workplan adopted by Metro Council,” they wrote, adding that in addition to being on pace to build far more units than expected, the bond has produced new affordable housing in places that have typically not been served: 45% of bond-funded units are in areas historically inaccessible to communities of color, and 42% of units are in areas that have historically lacked affordable housing.

They also agreed with the findings of Evans’ team and pledged to address the funding gap for administrative oversight.

“The audit flagged challenges because of the 5% administrative cap,” the Metro officials wrote. “Now that we have actual data on the cost to administer and oversee a regional housing bond program, we can use it to forecast costs for potential future bonds.”