A new study released today by the Oregon Center for Public Policy finds that Oregon’s tax system is less regressive than those in all but eight states—but it still allows the highest-earning Oregonians to pay a lower tax rate than the lowest earners.

The report, titled “Who Pays,” comes from the Washington, D.C.-based Institute on Taxation and Economic Policy.

A point of clarification: It’s been widely reported that Multnomah County residents have the second-highest personal income tax rate in the country. The new study looks more broadly, including personal income taxes but also taxes on corporate income, sales, property, estates, gasoline and cigarettes.

The Institute on Taxation and Economic Policy says it spent thousands of staff hours compiling the total tax burden from each state and then determining which are the most progressive, i.e., which states require the highest earners to pay the highest rates of taxes and which are the most regressive, i.e., allow the highest earners to pay relatively lower rates than low-income earners.

Oregon stacks up pretty well in the national ranking. Though less inequitable than most others, our system is still regressive, analysts from the Oregon Center for Public Policy note: “Oregon’s poorest families pay more in taxes as a share of income than any other group in the state—more than middle-income families and the rich.”

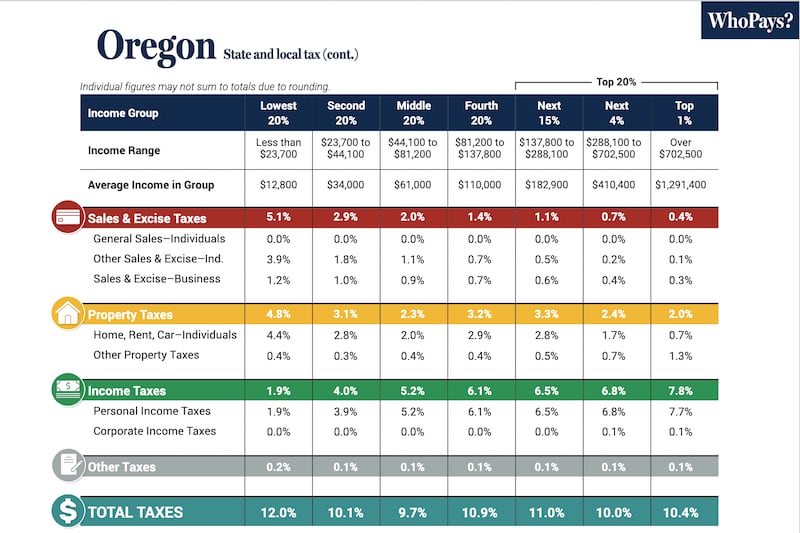

The report shows that Oregon’s poorest families pay about 12% of their income in taxes, while the 1% highest earners pay 10.4%. Interestingly, Oregon is the only state in which the middle 20% of earners pays the lowest rate.

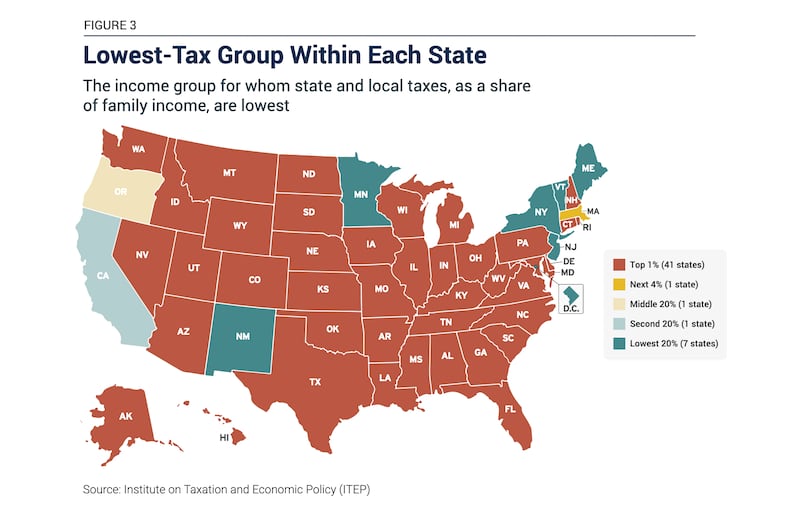

The study ranks states from most regressive (Florida) to least (Minnesota, if you don’t count Washington, D.C.). Oregon’s admirable ranking comes in part because we are one of only five states that don’t levy a broad-based sales tax.

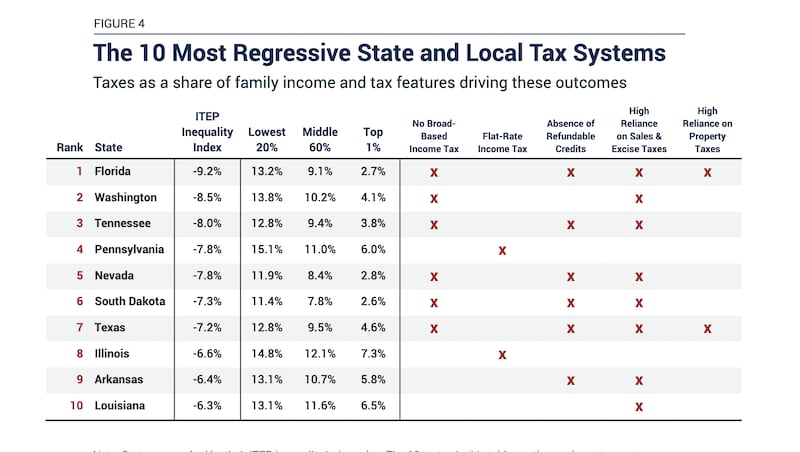

Here are the most regressive states, i.e., those in which low-income residents pay a relatively larger share of their income in taxes than do high-income earners:

And here’s the flip side:

Here’s a breakdown of the taxes Oregonians pay, by income levels:

Daniel Hauser, deputy director of the Oregon Center for Public Policy, took little satisfaction from Oregon ranking well and far better than Washington.

“Oregon’s lowest-income residents are struggling to afford rent and put food on the table,” Hauser said. “Asking these Oregonians to pay a larger share of their income in taxes than the highest-income Oregonians is a disgrace.”

He proposed two policy changes that could help Oregon make its tax structure fairer. First is a new tax on Oregonians who make more than $1 million a year. “A ‘millionaire’s tax’ would not only help correct our unfair tax structure, but also raise revenue to invest in child care, housing and other essential services,” Hauser said.

That concept is unlikely to gain much traction in Salem, if for no other reason than Gov. Tina Kotek in December made a three-year moratorium on new taxes part of her plan to revitalize Portland.

Hauser’s other idea, tax relief for low-income Oregonians, is an easier sell. “A big boost to the Oregon Earned Income Tax Credit would help to correct Oregon’s flawed tax structure by lowering the taxes of those who earn the least,” Hauser said. “More importantly, it would help struggling families make ends meet.”