A new report from the Oregon Center for Public Policy says two policy proposals—Initiative Petition 10, aimed at the November ballot, and Senate Joint Resolution 202, currently pending in Salem—would deprive local governments of their largest source of funding while worsening existing inequities.

Both would freeze the assessed values of homes owned by people 65 or older at current levels, meaning taxes on senior homeowners’ property would not increase until after their deaths.

The proposals come in response to a genuine issue—seniors whose fixed incomes don’t keep pace with the cost of living—but the report from OCPP, a left-leaning think tank, says a senior tax freeze would make matters worse in ways that are contrary to the broader public’s interests.

“They will eat away at the ability of local governments to pay for libraries, public safety, and many other local services, while also reducing funding for K-12 schools,” the report says of the freezes. “The proposals would also worsen economic and racial inequality, as they would disproportionately benefit the non-poor over those living in poverty, and disproportionately benefit white Oregonians over Oregonians of color.”

The report notes that homeowners already enjoy lucrative tax breaks not available to renters. “In the 2023-25 biennium, Oregon will spend about $915 million on the mortgage interest deduction and another $662 million on the property tax deduction. These subsidies exclusively for homeowners are some of the largest tax breaks contained in the state tax code.”

Oregon has an existing program under which the state pays property taxes for low-income seniors, loaning them the money at 6% interest and recouping the money after the homeowners sell their properties or die.

The new proposals are not need-based, however. That means they would benefit wealthy and poorer homeowners alike—while doing nothing for seniors who do not own homes.

“While claiming to be a response to housing unaffordability,” the report says, “the proposals exclude those Oregonians most likely to be burdened by housing costs: renters.”

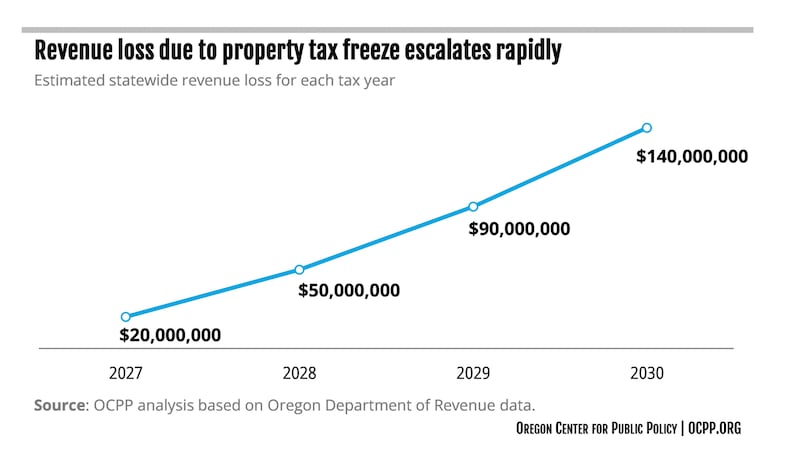

And tax revenue forgone by local governments would increase rapidly as the population ages and property values rise.

Oregon’s population, like the nation’s, is aging. The proposed property tax freeze would hit hardest in rural counties, many of which are already struggling financially because of stagnant populations and lack of economic activity.

“The share of Oregon’s population 65 and older is projected to rise from 18.6 percent in 2021 to 24.2 percent by 2050,” the OCPP report notes. “By 2050, seniors are projected to account for more than 40 percent of the population of some Oregon counties, including Curry, Grant, and Wheeler.”

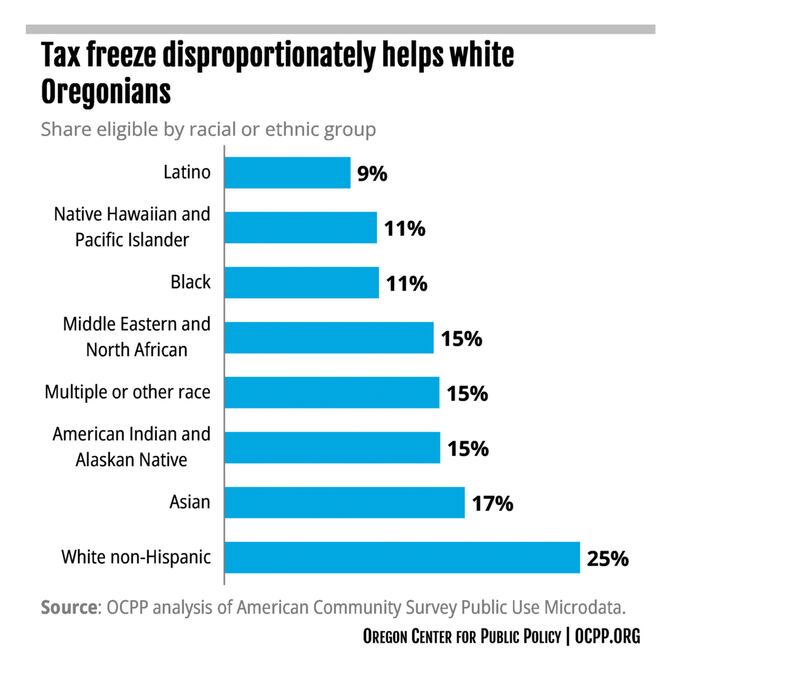

Because Oregon homeowners are disproportionately white, the proposed property tax freezes would widen the wealth gap between white and non-white Oregonians, the report found.

Finally, OCPP says, a senior property tax freeze would worsen an unfairness in Oregon’s property tax system that already exists: Houses with similar market values often have significantly different property tax bills.

“It would lead to more situations where owners of homes with the same or even higher real market value pay a lower property tax rate than an owner of a home with the same or lower real market value, while residents of both homes receive the same benefits from their local sidewalks, libraries, and health departments,” the report concludes.