After a briefing by a county economist this week, Multnomah County Commissioner Jesse Beason posted to social media a chart showing that wealthy residents pay the bulk of the controversial Preschool for All tax, as intended.

“I wanted to share data that shows only 6-8% of @multco residents pay this tax,” Beason wrote. “Around 80% of the revenue is collected from our wealthiest community members making over $500,000 annually.”

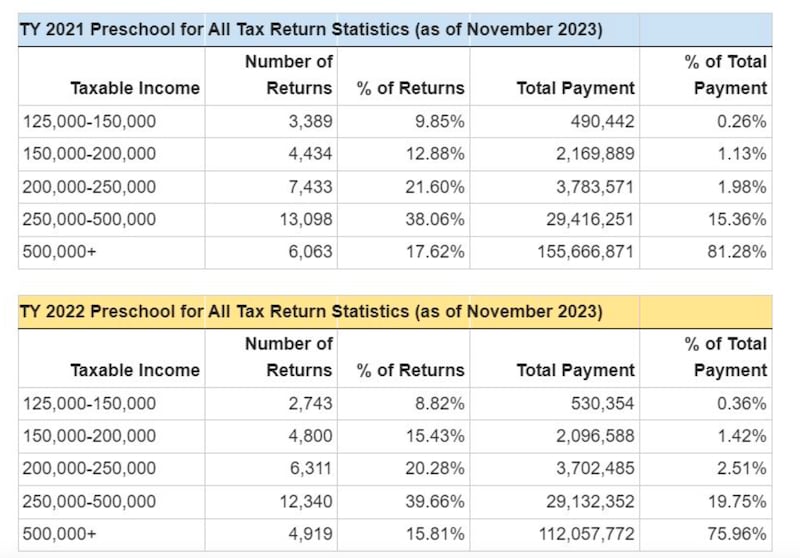

But the chart showed something else that is likely to incite Preschool for All’s critics: The number of people with taxable income that high who paid the tax fell 19%, to 4,919 in tax year 2022 from 6,063 in 2021. One possible explanation for that is that wealthy taxpayers have fled Multnomah County because of a tax burden boosted by local levies like the pre-K tax.

County economist Jeff Renfro, who presented the data to commissioners, says it’s too early to pin the decline on people fleeing to lower-tax jurisdictions like Clackamas County or Washington state. Multnomah County has only been collecting the Preschool for All tax for two years, hardly enough time to draw conclusions, he says.

“I don’t see evidence of a big exodus,” Renfro says.

Two more scenarios are more likely, he says.

First, there still may be filers out there who haven’t paid their 2022 taxes. Renfro says he pulled the 2022 data in November 2023, after the Oct. 15 deadline for people who sought extensions, but there still could be some laggards. That was the case in 2021, he says, the first year the county collected the Preschool for All tax.

Second, high earners who paid the tax in 2021 may not have made as much money in 2022. Say, for example, someone sold a property in 2021 and had a windfall that jacked up their income. Without such a sale, they might slide back down the tax brackets, Renfro says.

“People at the higher end have more volatile income,” Renfro says. “I think it is possible that they could drop below the tax threshold. It’s something we’re tracking very closely.”

Multnomah County residents filing alone don’t pay the 1.5% pre-K tax on any income below $125,000. For joint filers, the threshold is $200,000. There’s an additional 1.5% levy on taxable income over $250,000 for individuals and $400,000 for joint filers.

Income may indeed be volatile at the highest levels, but the decline in filers goes beyond the tip-top bracket. The number of payers with taxable income of $250,000 to $500,000 fell 6%, to 12,340 in 2022 from 13,098 in 2021, and those making $200,000 to $250,000 fell 15%, to 6,311 from 7,433.

And, overall, the total number of Preschool for All taxpayers fell 9.6%, to 31,113 from 34,417.

Renfro’s presentation confirms what many people already know, and what was intended by the 2020 ballot measure that created Preschool for All: The wealthiest payers foot the lion’s share of the bill. In tax year 2021, filers making $500,000 or more paid $156 million in pre-K taxes, or 81% of the total $192 million collected.

Losing those payers—whether to delays that will resolve themselves, or to lower income, or to moving—cost the program revenue in 2022. That year, the highest earners paid $112 million, a decline of $44 million from 2021. Their share of the total fell to 76%.

On a per capita basis, the wealthiest tax filers paid an average of $22,781 in tax year 2022, down from $25,675 in 2021. At the other end of the pre-k tax spectrum, payers with taxable income between $125,000 and $150,000 paid an average of $193 in 2022, up from $145 in 2021.

Renfro presented his data at a work session on whether the county should delay an increase in the Preschool for All tax that’s scheduled for 2026.

County Chair Jessica Vega Pederson, a champion of the tax, said in February that she would like to delay the increase, which is set to boost the tax to 2.3% from 1.5% on Jan. 1, 2026, to align with Gov. Tina Kotek’s three-year tax moratorium.