When people talk about Oregon’s tax structure, they often say the state has a two-legged stool and one of those legs is a little short.

What they mean is that, unlike most states, Oregon doesn’t have a state sales tax. It relies on an income tax, which is high relative to other places’, and property taxes, which, with some exceptions, can rise no more than 3% per year. So, the tax revenue available to pay for services fluctuates more than in states with more types of taxes. When people’s incomes go down, Oregon’s revenue slumps and it can’t make up the difference with sales tax revenue or higher property taxes.

The two-legged stool is unstable.

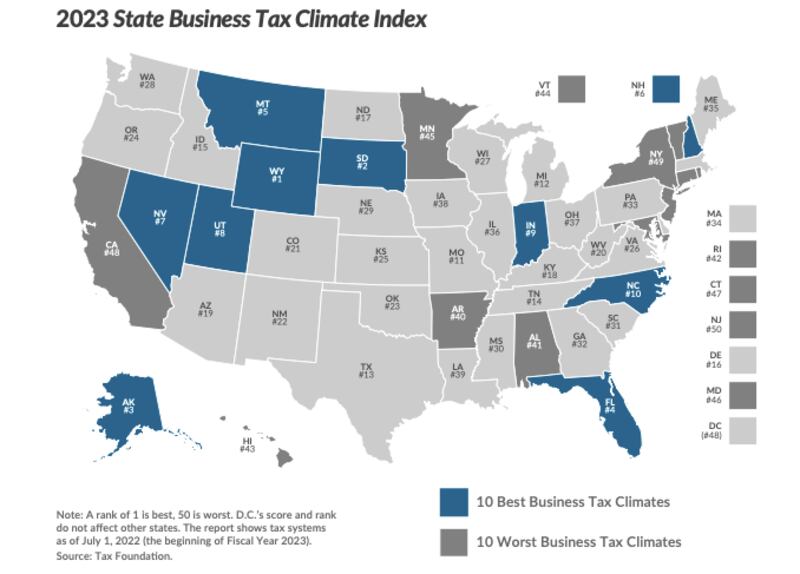

It’s perhaps a surprise, then, that Oregon’s wonky tax regime lands it smack in the middle relative to other states in terms of how well it attracts new businesses, generates economic growth, and creates jobs. In its annual ranking, the Tax Foundation, a nonpartisan, nonprofit think tank, put Oregon at 24th out of 50, just behind Oklahoma and ahead of Kansas.

The worst state this year, taxwise, is New Jersey, and the best is Wyoming. Rank matters, the Tax Foundation says, because companies shop where to locate offices, plants—and jobs.

“The evidence shows that states with the best tax systems will be the most competitive at attracting new businesses and most effective at generating economic and employment growth,” the Tax Foundation said in its report.

The ranking comes from an index that combines all taxes: corporate, individual income, sales, property and unemployment insurance. The Tax Foundation gives high scores for taxes that are low, transparent and applied fairly.

A rival think tank, the Institute on Taxation and Economic Policy, says the Tax Foundation’s ranking is bunk.

“The Index is constructed in a way that is arbitrary, self-contradictory, and out of touch with the actual tax contributions of U.S. businesses,” the ITEP said in an Oct. 31 blog. “Discussion of the index tends to center around the need for lower (or nonexistent) taxation, even though state and local taxes make up a vanishingly small fraction of total business costs, and the services paid for with those tax dollars are crucial to the success of every business.”

A high score in one area can offset a low score in another. With its unusual tax structure, Oregon hits the extremes. In terms of sales tax, which is zero—except for taxes on a few products, such as gasoline—Oregon ranks 4th.

But in terms of corporate taxes, Oregon ranks 49th—beating only Delaware—mostly because of the Corporate Activity Tax, which places a 0.57% levy on “commercial activity,” atop the state’s 6.6% corporate income tax rate. Unlike the corporate income tax, the CAT applies to sales, not profits. It is assessed “for the privilege of doing business in Oregon.” according to the state.

In terms of property tax, Oregon ranks a respectable 20th in the Tax Foundation’s eye. Thanks to Measures 5 and 50, passed in the 1990s, property taxes in Oregon cannot rise by more than 3% a year, unless there are improvements to a property.

But Oregon takes another hit on personal income tax, where it ranks 42nd, just below Ohio and just above Minnesota. Oregon’s top income tax rate, for any income over $125,000, is 9.9%. California has the highest top rate at 13.3%.

Five states don’t have a sales tax: Alaska, Delaware, Montana, New Hampshire and Oregon.

“The Tax Foundation’s State Business Tax Climate Index is an indicator of which states’ tax systems are the most hospitable to business and economic growth,” the Tax Foundation said. “The Index does not purport to measure economic opportunity or freedom, or even the broad business climate, but rather the narrower business tax climate.”