Oregon’s craft brewers are happy to be done with 2023, a year that saw softening demand and a spate of closures in an industry more accustomed to growth and expansion.

“It’s a tough moment for Oregon’s craft brewers,” says Ben Edmunds, the brewmaster at Breakside Brewery and president of the Oregon Brewers Guild. “Increased costs, changes in consumer preferences, and diminished on-premises consumption all made 2023 an especially challenging year.”

The casualties included award-winning local breweries, such as Ecliptic and Ex Novo, along with a slew of lesser-known names. Here’s a list compiled by beer writer Ezra Johnson-Greenough.

Oregon has long been a national leader in the craft brewing movement, but the headwinds the sector now faces are national in scope and include category-shifting to non-alcoholic drinks, reduced beer consumption overall, and a post-pandemic hangover that has put downward pressure on just about all alcoholic beverages.

In a December presentation to the industry, Bart Watson, the chief economist of the Brewers Association, which represents craft brewers nationwide, presented some hard truths.

“We were in double-digit growth as recently as 2014, 2015, and then we moved into kind of a more developed, slow, single-digit growth rate,” Watson said of the craft beer industry. “COVID hit, and we had the worst year in craft history in 2020 with a partial bounce-back in 2021.

“But what we’ve seen in 2022 and then 2023 is that the new normal is one where, at least in volume sales—and this is volume percentage growth, not dollars, dollars would be positive—that craft has moved into a no- to negative-growth territory,” he continued.

That’s tough for Oregon’s breweries (there were 318 at the end of 2022) and will no doubt come up in meetings of a new panel that will hold its first meeting Jan. 12: the Task Force on Alcohol Pricing and Addiction Services.

The task force was formed through legislation passed last year. Its charge is to “study alcohol addiction and alcohol addiction prevention; distribution of resources for alcohol addiction treatment; current overall funding for alcohol addiction treatment programs; cost of alcohol addiction to the state; benefits and drawbacks of imposing taxes on beer and wine; and additional funding options for alcohol addiction treatment.”

That panel will be chaired by Oregon Liquor and Cannabis Commission director Craig Prins, whose agency holds a monopoly on hard liquor sales in this state. (As WW reported last week, one of the loudest voices in the debate over alcohol policy, Mike Marshall, director of Oregon Recovers, won’t be part of the conversation since Gov. Tina Kotek ejected him from the panel for a controversial social media post.)

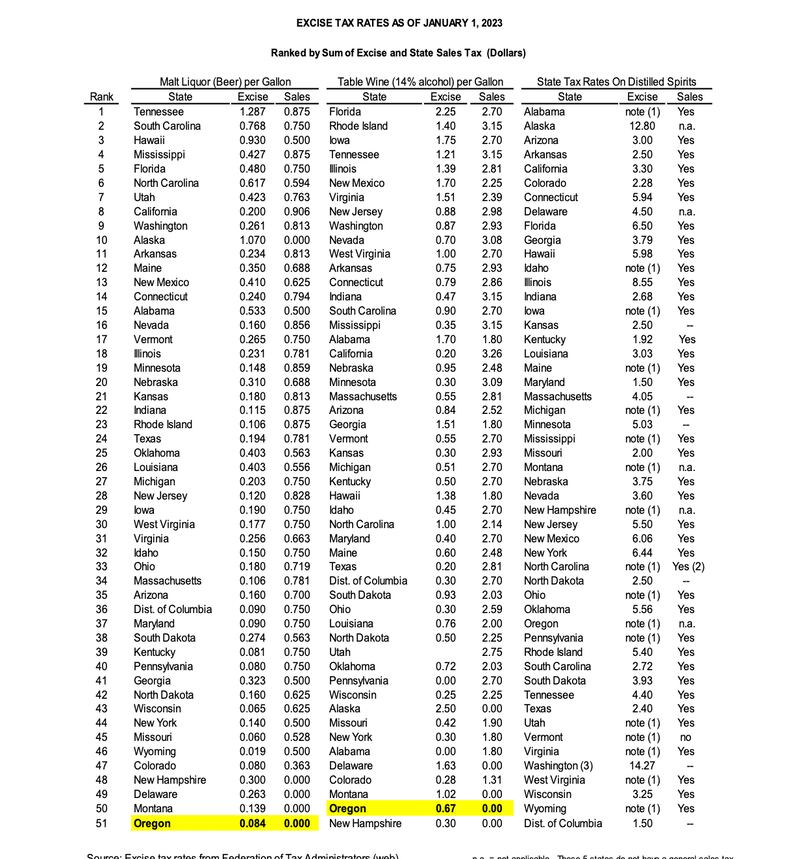

Expect the state’s homegrown beer and wine producers to push back hard against one of the reasons the task force exists: urging from temperance and recovery advocates such as Marshall for higher taxes on beer and wine as a way to decrease consumption and raise revenue to pay for treatment. The Oregon Beverage Alliance, which represents the alcohol industry and its partners, has steadfastly opposed increases in those taxes, which are among the nation’s lowest, according to the Oregon Legislative Revenue Office.

The Task Force on Alcohol Pricing and Addiction Services meets at 11:30 am on Jan. 12. More details about the meeting can be found here.