The Oregon Trucking Association and three member trucking companies filed suit today in Douglas County Circuit Court, alleging truckers have been disproportionately and grossly overcharged for road use under the state’s weight-mile tax.

The truckers brought the lawsuit against Gov. Tina Kotek, Senate President Rob Wagner (D-Lake Oswego) and House Speaker Dan Rayfield (D-Corvallis) in their official capacities and against the state of Oregon and the Oregon Department of Transportation.

At issue: truckers’ belief that that the state has overcharged them for their use of state roads.

“For at least the past six years, heavy-weight trucks have paid an ever-increasing and disproportionate share of the State of Oregon’s road revenue, contravening the mandate from the Oregon Constitution,” the lawsuit says.

Every two years, the Oregon Department of Administrative Services conducts a cost-allocation study. The agency draws on a team of economists and consultants to determine whether light vehicles—less than 10,000 pounds—and heavy vehicles, which weigh more than 10,000 pounds, are paying their fair share.

As the truckers allege in their lawsuit, the study has found that for three consecutive two-year budget cycles, truckers have paid disproportionately more.

“The extra burden on heavy vehicles is significant, immediate, and ongoing,” the lawsuit says. “ODOT has estimated that for the 2023-2025 HCAS, heavy vehicles will overpay by approximately $193 million per year. This amounts to an overpayment of more than $528,000 every single day.”

The constitution calls on the Legislature to ensure that the two classes of vehicles pay their fair share by adjusting the rates they pay, but the lawsuit says lawmakers, while acknowledging the current inequity, have failed to fix it.

“The Oregon Constitution mandates that light and heavy vehicles be treated fairly and proportionately,” the lawsuit says. “Yet DAS flatly states in its most recent Highway Cost Allocation Study that this is not occurring, with heavy vehicles overpaying by more than 32%. Thus, the current cost allocation is unconstitutional.”

Nobody disputes the issue is real. Members of the Legislature’s Joint Transportation Committee highlighted it during the 2023 session, and two lawmakers, Sen. Brian Boquist (I-Dallas) and Rep. Anna Scharf (R-Amity), went as far late last year as to ask for a special session solely to fix the problem (that request fell on deaf ears).

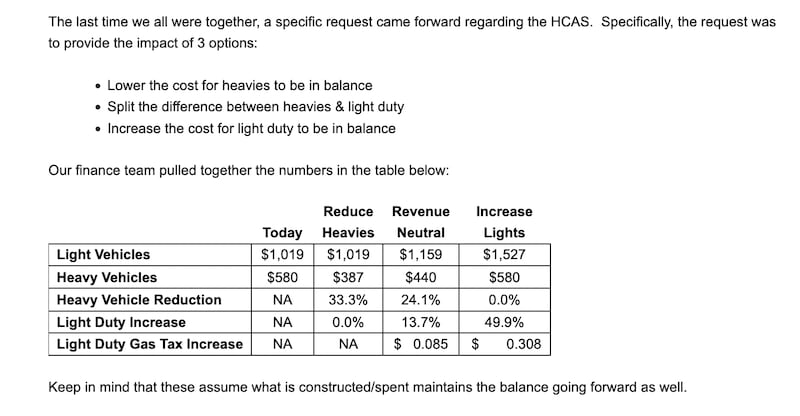

In a Nov. 3 email, ODOT director Kris Strickler presented options for fixing the problem to members of the Oregon Transportation Commission and the Joint Transportation Committee.

Each of the options Strickler laid out presents a problem for ODOT, which is in dire financial straits because the costs of future transportation projects keep escalating faster than the agency’s revenues, which are highly dependent on the gas tax.

The state could cut truckers’ taxes, but that would reduce ODOT’s revenues. They could raise gas taxes on light vehicles, but that would risk alienating drivers. So they’ve done nothing, and that’s what led to today’s lawsuit.

The three privately held Oregon firms that are plaintiffs in the case—A&M Trucking LLC in Glendale (Douglas County), Sherman Bros. Trucking Harrisburg (Linn County), and Combined Transport in Central Point (Jackson County)—say they have collectively overpaid their weight-mile taxes by $925,000 since January 2022.

The lawsuit asks the court to declare that the disproportionate collection of truck taxes violates the Oregon Constitution, order the state “conduct an immediate review and adjustment of revenue sources,” and order the state to pay the three plaintiff firms their $925,000 back.

Jana Jarvis, CEO of the Oregon Trucking Association, said in a statement that the state needs to fix the problem immediately.

“For far too long, Oregon trucking companies, the vast majority of which are mall, family-owned businesses, have paid far more than their fair share of transportation taxes. By 2025, the trucking industry is expected to have overpaid by half a billion dollars,” Jarvis said. “Trucks play a critical role in moving goods to communities and families in Oregon, and its long past time that we ensure they are paying their fair share of taxes.”

An Oregon Department of Justice said the agency had not yet reviewed the lawsuit.