Multnomah County voters overwhelmingly rejected a ballot measure that would have taxed profits on sales of stocks, bonds and real estate to pay legal fees for people facing eviction, early election returns show—a sign that Portland voters are surfeited on new local taxes.

In first returns, Measure 26-338 was being defeated 83% to 17%, according to the Multnomah County Elections Division.

Had it passed, the measure would have been the first capital gains tax imposed by a U.S. county. After regional tax increases to combat homelessness and pay for preschool for all, top earners in Portland now pay the second-highest total state and local income tax rate in the nation—14.69%—exceeded only by New York City at 14.78%, according to a report from Ernst & Young commissioned by Oregon Business & Industry. That rate is levied only on income above $125,000 for individuals and $250,000 for married couples filing together.

Backers of Measure 26-338, including the Portland chapter of the Democratic Socialists of America, said the 0.75% tax would raise as much as $15 million a year to pay for eviction lawyers and services. Fewer than 10% of Oregonians facing eviction have legal counsel, while landlords always do, backers said.

The initiative faced an uphill battle because it didn’t exempt profits from the sale of primary residences, an error that the Eviction Representation for All campaign acknowledged. That means a retired senior living on a modest income might have had to pay taxes on decades of price appreciation on his or her primary residence.

The tax was also to be retroactive to Jan. 1, 2023. Normally, new taxes start after a measure passes. If Measure 26-238 had passed, many county residents would have incurred tax liabilities they didn’t know about.

The city of Portland’s Revenue Division, which would have collected the tax for the county, estimated startup costs at $19 million. Administrative costs would have soaked up about half the tax annually thereafter, the division estimated.

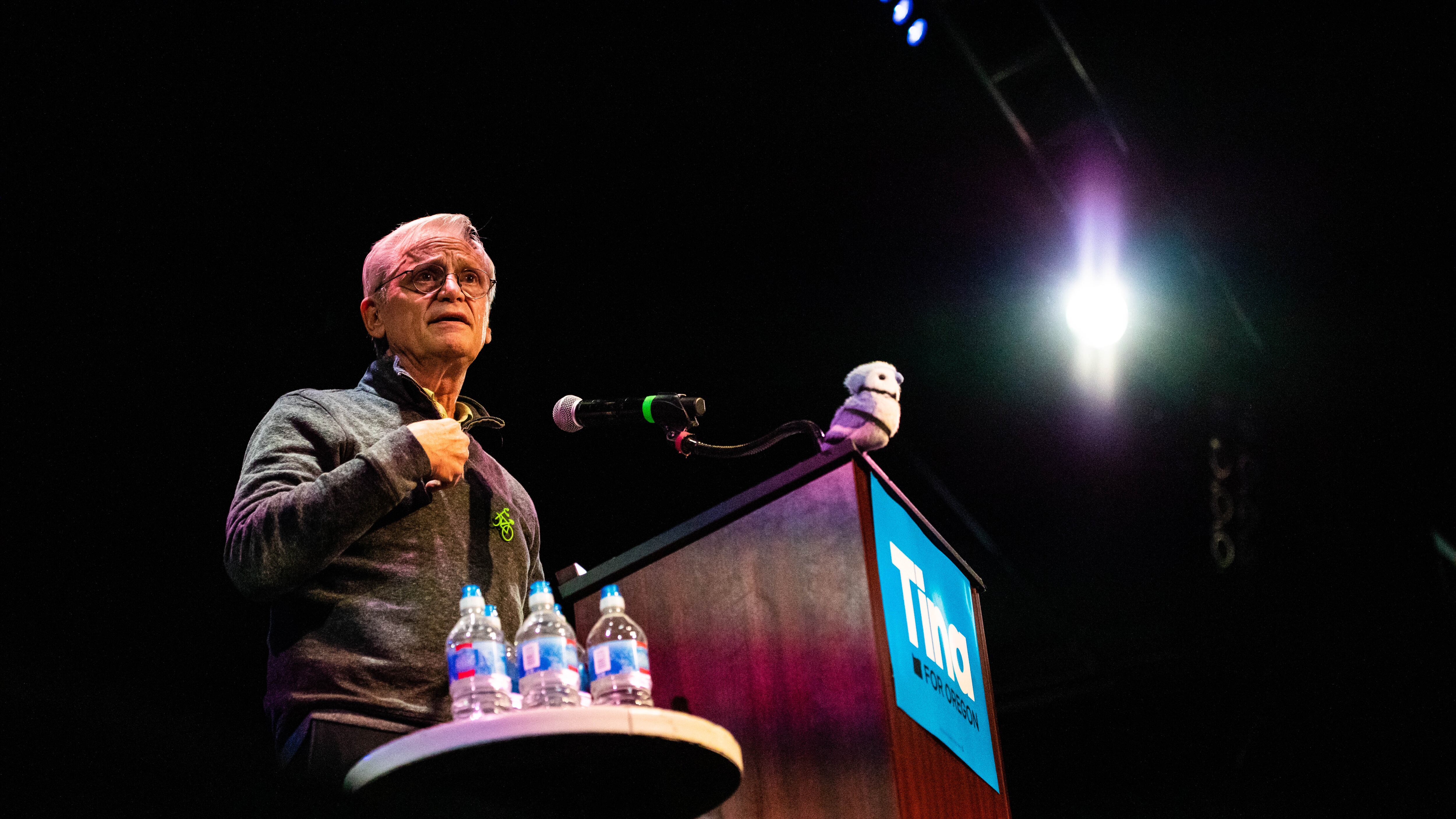

Opponents of the measure took a victory lap tonight.

“Good intentions don’t always lead to good policy,” Andrew Hoan, president of the Portland Business Alliance, said in a statement. “Voters understood that we don’t need another tax on local families and small businesses when we already have tax-funded programs in place to help tenants facing eviction.”

“Voters tonight have protected local families, seniors, and small business owners by rejecting this tax measure, which had no limits and no safeguards,” Lance Randall, executive director of the Black Business Association of Oregon, said in a joint statement with the PBA. “This tax would have been an unfair burden on small business owners, particularly Black, Asian and other BIPOC business owners, in an already-challenging economic environment.”

Proponents of Measure 26-338 didn’t immediately return an email seeking comment.

No other city or state that funds eviction relief lawyers chose to do so with a capital gains tax. Some use federal funds. Boulder, Colo., imposed a tax in 2021 on rental units.

The other tax measure on Portlanders’ ballot, a renewal of the Portland Children’s Levy, was passing easily in early returns, 67% to 33%.

Read election results for Multnomah County commissioner here and the Portland Public Schools board here.

(This story has been updated to show that the top rate for taxpayers in Portland is levied only on income above $125,000 for individuals and $250,000 for married couples filing together.)