This story was produced by the Oregon Journalism Project, a nonprofit newsroom covering the state.

After another session in which some lawmakers tried again—and failed again—to raise the $1 million threshold at which Oregon’s estate tax kicks in, state Rep. Kevin Mannix (R-Salem) and co-petitioner Michelle Mhoon have filed a ballot initiative to do away with the tax completely.

Initiative Petition 51, the “End the Death Tax Act,” would terminate the tax on the estates of Oregonians who die after Jan. 1, 2027. In their July 15 filing, Mannix and Mhoon aim to place the initiative on the November 2026 ballot.

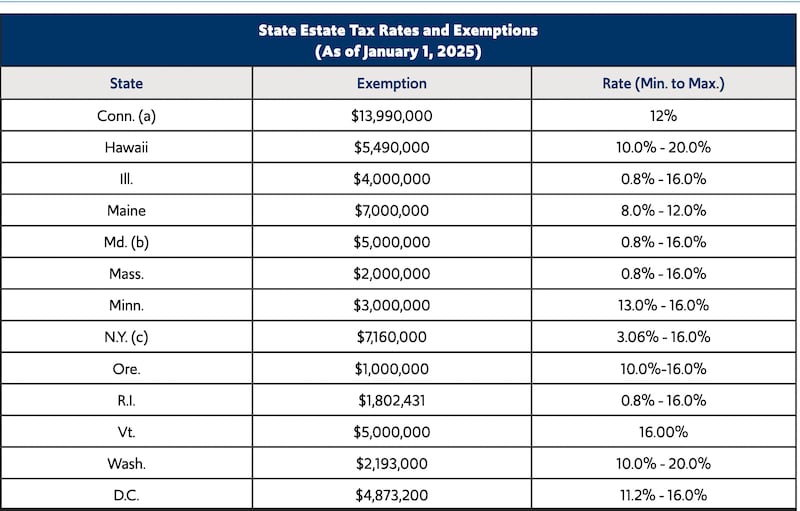

The issue has surfaced repeatedly in Salem, in part because Oregon is one of only a dozen states that levies an estate tax. Lawmakers have made certain changes over the years to benefit families who own natural resource businesses, but the tax for individuals has remained unchanged for decades.

In March, the Common Sense Institute published a white paper on the estate tax that compared Oregon to other states.

Oregon’s estate tax brings in a lot of money: $339 million in 2024, according to the Legislative Revenue Office. That number increased 297% over the past decade, more than any other source of significant state revenue.

In the debate over House Bill 2301, which would have raised the estate tax threshold to $7 million and lowered the tax rate to 7%, both sides presented compelling arguments. (Mannix, a prolific ballot measure author and wily dealmaker, was a co-chief sponsor of the bill.)

Proponents, including Oregon Business & Industry, argued the $1 million threshold has remained unchanged since 2002, even as the value of property, stocks and other assets have skyrocketed, creating an incentive for people to move away from Oregon, taking their wealth and its benefits to the community with them.

Opponents, including Tax Fairness Oregon and the Oregon Center for Public Policy, argued the tax affects relatively few people and supports basic public services, and that raising the threshold would increase the yawning gap between rich and poor. The bill died in committee.

Oregon voters have considered the issue before. In 2012, Measure 84 proposed a gradual phase-out of the tax. Voters rejected it 54% to 46%.

Petitioners must now gather 1,000 sponsorship signatures to begin the ballot title process. If they achieve that goal, they must then gather 117,173 valid signatures to qualify for the November 2026 ballot.