This story was produced by the Oregon Journalism Project, a nonprofit newsroom covering the state.

When Oregon lawmakers convene in a special session Aug. 29 to decide whether to raise the gas tax and bail out the Oregon Department of Transportation, most will likely be operating on the reasoning of a well-honed ODOT sales pitch:

The agency is broke and Oregon underfunds its roadways compared to six nearby Western states, so it needs more money.

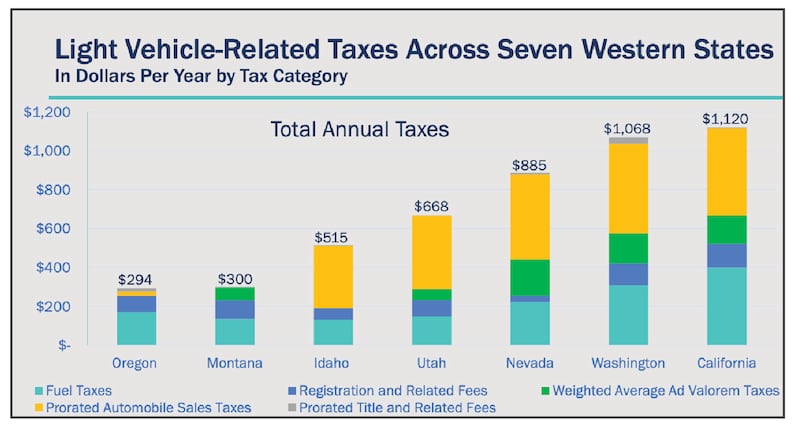

In June testimony, ODOT even provided lawmakers with a chart of taxes collected per car in the seven states. The graphic is eyecatching: It shows Oregon ranked at the bottom, at $294 per vehicle. Washington and California ranked at the top, at more than $1,000.

ODOT’s Misleading Chart

Scary stuff, until you understand that ODOT’s calculation included sales taxes on cars—Oregon, of course, does not charge a sales tax (although ODOT does collect a 0.5% privilege tax on some vehicle sales). The absence of a sales tax dropped Oregon to the bottom of the bunch. But Joe Cortright, an economist who tracks ODOT’s budget carefully—and the subject of an extensive interview this week with the Oregon Journalism Project—says the agency’s chart is misleading.

“State sales taxes on cars warp the comparison,” Cortright says. “Other states do charge sales taxes on car sales, but this money goes to general funds, not to road construction and repair.”

After seeing the chart, which circulated widely, Cortright sent a letter to each lawmaker making this point.

“ODOT’s numbers are a bogus and deceptive sales technique,” Cortright insists.

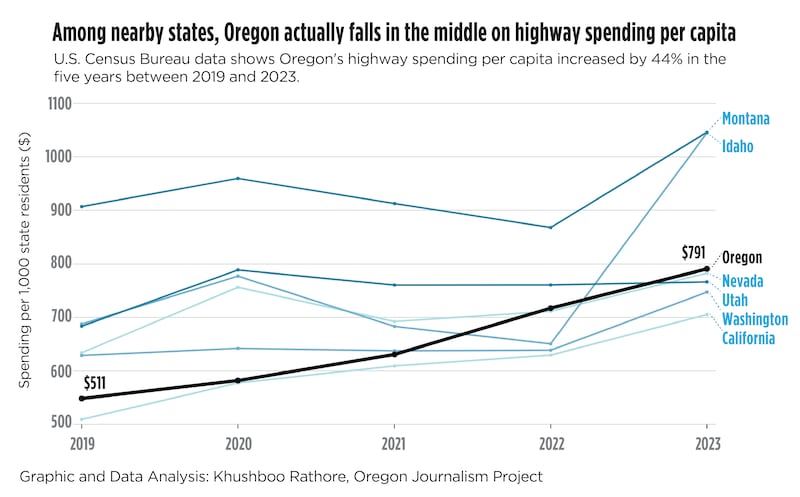

U.S. Census Bureau data supports his contention. An OJP analysis of five recent years’ spending figures show that Oregon falls roughly in the middle of the other six states cited by ODOT: California, Washington, Nevada, Utah, Idaho and Montana (see graph below).

Whether this alternative picture of reality plays a role in the upcoming transportation debate in Salem remains to be seen.

ODOT, which had a $6.9 billion budget for biennial 2023–25, says it faces a “funding crisis” because it isn’t allowed to shift allocated funds from projects to maintenance and needed repairs and because fuel tax revenues and fees have failed to keep pace with inflation.

After lawmakers failed to pass a funding bill before the regular session concluded in June, the agency and Gov. Tina Kotek said they would have to lay off hundreds of workers and close 12 ODOT maintenance centers.

In order to prevent those layoffs, the governor has released a funding proposal that would increase gas taxes and other fees in 2025–27 by $620 million, which would be split among ODOT and Oregon counties and cities.

Meanwhile, some influential Democrats have staked out positions that conflate ODOT tax revenue collection (money in) with its actual spending on roads (money out).

House Speaker Julie Fahey (D-Eugene), in a July 13 interview with KATU-TV, said: “We are the lowest of the seven Western states in what we spend on roads and bridges, [and] that has real world consequences for the safety of Oregonians, for how we maintain our roads and bridges.”

OJP recently shared its analysis with Fahey that showed Oregon was about average among the seven Western states for spending on highways and roads.

“You’re correct that the Speaker misspoke in the KATU interview—she was referring to taxes and fees related to transportation, not the spending side,” a spokesperson replied.

This story has been updated to include a response by House Speaker Julie Fahey (D-Eugene).